In every election cycle, the citizens of this country have the opportunity to vote for their leadership in every level of government, from local to federal, choosing the leadership that best aligns with their worldview. But in addition to leadership, citizens can vote for state and local ballot measures which will have immediate impacts on their daily lives. So, what is a ballot measure? According to Ballotpedia, “a ballot measure is a law, issue, or question that appears on a state or local ballot for voters to decide.” In 49 states, Delaware being the sole exception, state constitutions can only be amended through ballot measures, and in 26 states, citizens can collect signatures to put forth their own ballot measures. Here are six from this year’s elections across the country:

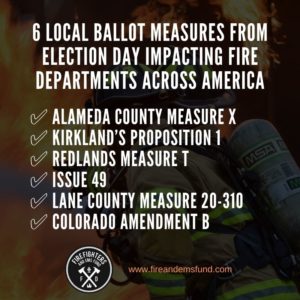

Alameda County Measure X

This local ballot measure in California addresses the chronic underfunding that fire departments across the country are faced with each and every year. Ballotpedia cites that “A “yes” vote supports authorizing the Alameda County Fire Department to issue up to $90 million in bonds with bond revenue going to fund fire station repairs to maintain services and requiring an estimated property tax levy of $15.70 per $100,000 in assessed value.” A supermajority of 66.67% of voters were required to pass this ballot measure. The measure squeaked by, passing with 66.78% of the vote on Nov, 3rd.

Kirkland’s Proposition 1

In Washington state, a similar tax levy was proposed in Kirkland, Washington to levy an increase on property taxes to help fund the local fire department. According to King 5 News, voting yes on “Proposition 1 would mean a 24 cent increase, per $1,000 of assessed value, to property taxes. The city estimates it would cost about $171 for the median home in the city and there’s no expiration for it.” The increased revenues are to be used to upgrade the city’s fire department and hire more firefighters.

Redlands Measure T

This ballot measure proposed using a targeted sales tax increase to provide more funding for an umbrella of public services, fire & emergency services included. According to Ballotpedia, “A “yes” vote supports authorizing an additional sales tax of 1% generating an estimated $10.7 million per year for city services including safety, emergency services, law enforcement, addressing homelessness, and maintenance of libraries, parks, sidewalks, roads and public areas…” A simple majority was required, and the measure passed with 57.32% of the vote.

Issue 49

This measure in Strongsville, Ohio was proposed on November 3rd to provide additional funding to the city’s fire department. According to FireRescue1, the measure was a proposed property tax increase “that would have helped pay for additional firefighters and firefighter-paramedic equipment.” Unofficial results have determined that the measure has failed, with 54% of voters rejecting the measure on Election Day. Fire Chief Jack Draves noted that while the city currently has sufficient resources to meet community needs and avoid furloughs, “Overtime to backfill unscheduled absences remains suspended.”

Lane County Measure 20-310

In Lane County, California, citizens had the chance to vote on Measure 20-310. According to The Register-Guard, the measure “proposed a five-year $6.42 million levy to hire three full-time firefighter-medics in the Veneta-based district…The proposed tax rate was $0.50 per $1,000 of assessed value, which yielded the possibility of increasing property taxes by more than 3%.” The measure was proposed as a means to create better coverage and response time for fire services, and to help replace and repair fire apparatus. 62.09% of the public voted “No” on this measure.

Colorado Amendment B

This statewide amendment in Colorado sought to amend the “Gallagher Amendment,” which limits “…property taxes to 45 percent of the statewide tax base,” according to CPR. In other words, the Gallagher Amendment would periodically mandate a reduction in residential property taxes. Voting for Amendment B on November 3rd was a vote to repeal this stipulation, and “allowing the Colorado State Legislature to freeze property tax assessment rates at the current rates (7.15% for residential property and 29% for non-residential property,” according to Ballotpedia. This amendment was proposed to keep funding for services like fire & emergency services funded at a stable rate. The measure passed with 57.52% of the vote.

As the demand for emergency services across the country increases, so do the needs of our firefighters. One way to secure funding, protection, and attention to urgent matters is through the tried-and-true process of passing legislation. From cancer protection to tax incentives, here’s a roundup of firefighter and EMS bills and legislation that passed, failed, and are still on the table in early 2020.